Instability is accelerating in many spheres of life on Earth.

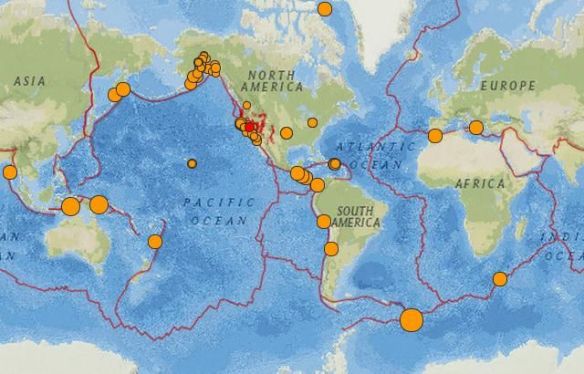

Earthquakes have accelerated beyond the record-setting pace described in Rockin’ and Rollin’ with sixteen magnitude 6.0 quakes in the first sixteen days of May. So we’re running at the rate of one major quake per day. Here’s the list:

| Date/Time | Magnitude | Place |

| 2014-05-16T11:01:42 | 6 | 113km NE of Grande Anse, Guadeloupe |

| 2014-05-15T10:16:41 | 6.2 | 50km WSW of Alim, Philippines |

| 2014-05-15T08:16:34 | 6.6 | 96km SSE of Ifalik, Micronesia |

| 2014-05-14T20:56:13 | 6.1 | 99km SSE of Ifalik, Micronesia |

| 2014-05-13T06:35:24 | 6.5 | 108km SSE of Punta de Burica, Panama |

| 2014-05-12T18:38:37 | 6.5 | Southern East Pacific Rise |

| 2014-05-10T07:36:01 | 6 | 11km W of Tecpan de Galeana, Mexico |

| 2014-05-08T17:00:17 | 6.4 | 15km N of Tecpan de Galeana, Mexico |

| 2014-05-07T04:20:33 | 6.1 | 96km SW of Panguna, Papua New Guinea |

| 2014-05-06T20:52:26 | 6.1 | West Chile Rise |

| 2014-05-05T11:08:43 | 6 | 9km S of Mae Lao, Thailand |

| 2014-05-04T20:18:24 | 6 | 23km ESE of Ito, Japan |

| 2014-05-04T09:25:14 | 6.1 | South of the Fiji Islands |

| 2014-05-04T09:15:53 | 6.6 | South of the Fiji Islands |

| 2014-05-02T08:43:37 | 6 | 70km SSE of Namlea, Indonesia |

| 2014-05-01T06:36:35 | 6.6 | 201km WNW of Ile Hunter, New Caledonia |

And Oklahoma, famous for tornadoes but hardly for quakes, has seen an incredible increase in earthquakes with a magnitude of 3.0 or greater, from about two per year from 1975-2008, to forty per year in recent years:

What’s causing the huge spike in earthquakes in Oklahoma?

The US Geological Survey found that from 1975 to 2008, central Oklahoma experienced one to three 3.0-magnitude earthquakes a year, compared with an average of forty per year from 2009 to 2013. And it looks like that number is going to get bigger. It’s only February, and the state has already logged more than twenty-five quakes of 3.0-magnitude or larger this year, and more than 150 total quakes in the past week alone.

This instability isn’t just in the Earth’s crust. Check these real estate statistics that came out of China late last week:

- 1st-tier cities sales fall 40% y/y (year over year)

- 2nd-tier cities sales drop 65% y/y

- 3rd-tier and 4th-tier cities sales decline 32% y/y

In a country where real estate development has played an outsized role in their long economic boom–and on a planet where Chinese economic growth has contributed greatly to the world not sliding off into total Depression–these dropoffs are shocking. The Chinese government has been well aware that they have a real estate bubble, and they’ve been trying to deflate it gradually, but those numbers don’t quite equate with “gradual.” Their solution to bring things back to life? What else? No money down!

In China Homes Are Offered “Zero Money Down”

Since March, 20 property developers in Guangzhou have been offering “zero down-payments” to attract buyers, in addition to large discounts and tax refund, the National Business Daily reported Monday.

I’m sure that will work out real well.

How big is the China real estate bubble? It turns out someone at a private business meeting surreptitiously recorded the comments on this very topic by the vice-chairman of China’s biggest property developer. He describes Chinese real estate as an epic bubble:

“In 1990, Tokyo’s total land value accounts for 63.3pc of US GDP, while Hong Kong reached 66.3pc in 1997. Now, the total land value in Beijing is 61.6pc of US GDP, a dangerous level,” said Mr Mao.

“Mr Mao said China’s house production per 1,000 head of population reached 35 in 2011. The figure is below 12 in most developed economies “even when the housing market is hot; no country has a figure of greater than 14”.

The Chinese have been so enamored of real estate that they’ve been buying lots of it in California as well:

In California, Chinese nationals and immigrants are “parking their cash in single-family homes,” said Meyers.

In Irvine, Calif., for example, 80% of sales over the past year were to Chinese buyers, he said.”

This is a massive amount of targeted home purchasing in one city. I’ve had a few contacts that sell homes in the Orange County market telling me that 7 out of 10 purchases were going to Chinese buyers, all with cash offers…Irvine is no small city with 230,000+ people living in the city.

These frenzies always work out so well in the long term. Sure. (Do I even need to say it to anyone considering buying residential real estate in California, where bidders now present PowerPoint presentations about their offers to the owners? Be careful out there!!!)

And speaking of China and instability, Japan and China have been rattling the war sabers, but most aren’t aware that they are in a no-holds-barred currency war, with each country struggling to take down the value of its own currency to try to make their exports cheaper in world markets. Currency wars don’t generally end well.

And China has territorial disputes not only with Japan, but with Viet Nam and the Philippines as well. We’ll cover those in a separate post on how the War Cycle is progressing.

And what about instability in the banking system. So far this year there have been sixteen high-profile banker deaths: murders by angry customers, suicides, and mystery deaths. By mystery deaths I mean deaths under very suspicious circumstances where the deceased gave no indication at all of wanting to commit suicide, for example, sending an e-mail to a spouse arranging that night’s dinner plans–just an hour before they jump out of a 30th floor window? Some of these people were involved in government investigations of their activities and so they may have known more than their employers wanted them to divulge. Or perhaps these employers–it turns out that the four largest US banks hold $680 Billion in life insurance on their individual employees–simply want to collect on some insurance policies. And trying to find out about this doesn’t work because the US regulators are calling this a “trade secret” of each of the banks:

Suspicious Deaths Of Bankers Are Now Classified As “Trade Secrets” By Federal Regulator

Well, if anyone wants to verify any of this–though I don’t recommend it–here is a starting point:

52 Year-Old French Banker Jumps To Her Death In Paris (After Questioning Her Superiors)

And here is the strange story of a guy who worked for the US Federal Reserve for 26 years threatening his boss, the head of a major US housing agency, with murder, apparently over a bad job review the boss gave him!?!

Former San Fran Fed Employee Threatened To Murder Ex-FHFA Head Ed DeMarco

Stranger still is that the guy was easily released on bail.

So people seem just a bit testy in the banking and finance world. The question for the rest of us is: how much of our savings do we want in these people’s hands? You know my vote.

Instability has unexpected consequences. Some countries, such as Pakistan, are now so unstable that polio is making a comeback:

In February, the WHO found that polio had also returned to Iraq, where it spread from neighboring Syria. It is also circulating in Afghanistan (where it spread from Pakistan) and Equatorial Guinea (from neighboring Cameroon) as well as Nigeria, Ethiopia, Somalia and Kenya.

I guess those countries are on the Who’s Who list of instability.

This post could go on and on, but I’ll end with a high-quality video showing some of the earth changes and extreme weather in April:

Signs Of Change The Past Month Or So 2014 (4) April/May