If you would like indications–some from the true but lighter side–of just how wacky things have become, read on.

We’ve all heard that 2015 Was Hottest Year in Recorded History, Scientists Say, but it’s been so warm in the UK this “winter” that:

Our last post described–with world trade volume collapsing–how inexpensive it has become to ship things around the globe, leading to this:

It Is Now Cheaper To Rent A Dry Bulk Tanker Than A Ferrari

From Bloomberg:

Rates for Capesize-class ships [pictured above] plummeted 92 percent since August to $1,563 a day amid slowing growth in China. That’s less than a third of the daily rate of 3,950 pounds ($5,597) to rent a Ferrari F40, the price of which has also fallen slightly in the past few years, according to Nick Hardwick, founder of supercarexperiences.com.

In China, these three photos from Red Ponzi Ticking show:

A full-size Chinese replica of the Pentagon. To house the Chinese military brass? Nope, it’s a shopping mall, which currently has no tenants and no customers:

Here’s a Chinese full-scale copy of the buildings of Lower Manhattan. Construction cost? $50 Billion:

But here’s what it looks like at street level, since it also has no tenants:

But these types of expenditures make it seem like the economy is humming along, that is, it’s great for the economic statistics, even if the activity makes little or no sense.

So what is a developer with no tenants to do? Apparently, take action: “This 27-storey high-rise building which was completed on November 15th 2015 was just demolished, ‘having been left unused for too long.’ ”

And from Could China’s Housing Bubble Bring Down the Global Economy?:

Many people claim the estimated 65 million empty flats held as investments by the middle and upper classes in China will be sold to new buyers in due time. But these complacent analysts overlook the grim reality that the vast majority of urban workers make around $6,000 to $10,000 annually, and a $200,000 flat is permanently out of reach.

Average flats in Beijing now cost 22X annual household income — roughly six times the income-price ratio that is sustainable (3 or 4 X income = affordable cost of a house).

Perhaps we should send that Chinese demolition crew to Vancouver. If you think you’ve seen a real estate bubble where you live, check out this one:

I hope that plastic chair is included in the price. OK, so the Canadian Dollar has lost 26% of its “value” over the last two years. But still, $2.4 million? Checking the listing, one finds:

Excellent locations within walking distance to Lord Byng Secondary, Jules Quesnel, Queen Elizabeth Elementary, West Point Grey Academy & 10th Avenue shops.

Whew, now it makes sense! And here I thought it was overvalued. Being near those 10th Avenue shops must be worth at least a million.

This month, the US bought the most military aircraft and parts since just after 9/11/2001:

(Source)

I guess when the economy is tanking, what’s a government to do but buy more death machines. And they do have to put something in all those military bases out there:

In keeping with the great economic recovery meme, this is what’s happening to the formerly ever-expanding global octopus Wal-Mart:

WalMart To Fire 16,000 As It Closes 269 Stores Globally

Speaking of “always low prices”:

This $250,000 Caterpillar Bulldozer Can Be Yours For The Low, Low Price Of $55

These normally sell new for $1 million, used for $250,000, but here’s one where the high auction bid is $50 at a site in Lousiana, USA:

And it has companions, with a high bid of $100 for this:

and this one has a high bid of $10:

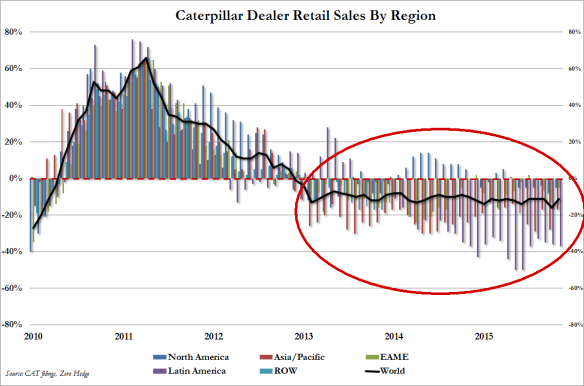

I guess the oil and real estate businesses are not exactly booming in Louisiana. Though it isn’t just Louisiana. Here is a chart of worldwide sales by bulldozer-maker Caterpillar for the last six years. It shows that their sales have been declining for 36 months in a row. All of those bars, starting in 2013, that extend below the zero line (shown in the red oval) show the percentage decline in sales. And this is during the alleged “economic recovery.” I wonder what this chart will look like next time the authorities admit to the anti-recovery:

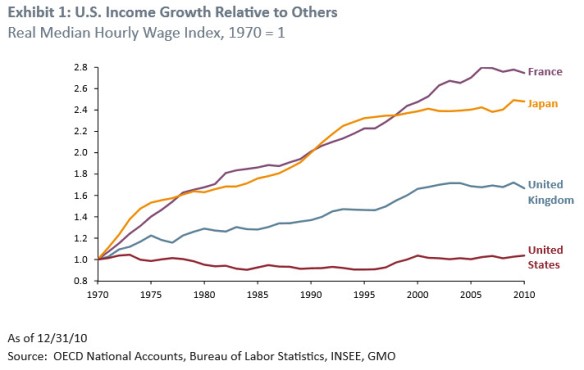

Here are two charts from a Jeremy Grantham article “Give Me Only Good News” in which he documents how easily manipulated and delusional Americans can be. You know how business people who call themselves “job creators” often claim that America is so much better for business than France since France is run by a bunch of socialists who are bad for business? And that “bad for business” means bad for people since only ever-expanding and profitable businesses can create jobs and grow wages for people in the long run? And people believe all that? Well here’s a chart showing what they actually mean. It shows that real (adjusted for inflation) wages in France are up 2.7-fold since 1970, whereas US real wages are actually lower than they were in 1970. Wage growth in the US badly lags that in other countries:

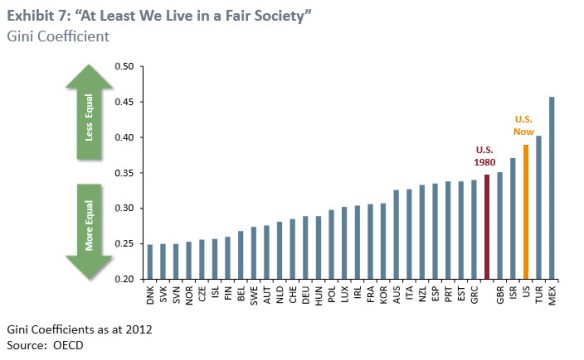

So, it’s good for business owners in America, not so good for the workers. Want more proof? Here’s a chart of the gini coefficient for industrialized countries. The gini coefficient measures wealth disparity, that is, it is taken as the best measure available for income inequality. Here is Grantham’s “At Least We Live in a Fair Society” delusion chart showing that only Turkey and Mexico have greater income inequality than the US, and that the US is much worse now than it was in 1980:

Speaking of easily manipulated, you know how Wall St always tells people to not worry about stock market declines, that “stocks always make money in the long run”? And most people believe it. Well here’s a chart of the stock market of Cyprus for the last nine years:

(Source)

That’s a 99.986% loss, folks. One has to wonder how long the “long run” will be in Cyprus. Of course, the EU and the IMF famously “fixed” Cyprus with the first of the bank bail-ins, in which depositor money was confiscated to keep a large bank from insolvency. Good thing for non-Cypriot stock markets that there won’t be any more bank bail-ins. Oh wait: this is from EU takes six countries to court over bank bailout scheme:

The EU on Thursday said it would take six member states to court for failing to implement a European-wide plan…

for bank bail-ins. (All industrialized economies now have bank bail-in rules on the books.) In other words, the authorities are trying to get ready for the inevitable next time things really hit the fan.

Sounds like a good idea. Getting ready, that is. (Side note: Getting ready takes a good deal of thought. And work. And time.)

Currently, the world is experiencing the turbulence phase in this video. Sooner or later, the bridge will collapse: