First, a digression right off the bat: let me say that I hope everyone who is interested in the precious metals is doing their own research on this topic so that they can make truly informed decisions, especially since I am not a registered financial advisor of any type, these are just my views of the world. One of the best ways I know to become informed on the metals is to get the free e-mails issued by GATA, the Gold AntiTrust Action Committee. You can sign up for their e-mails here. They send out links daily pointing to the best articles about gold and related topics from across the web. OK, end of digression.

* * *

Since I was wrong last Spring about when gold would make its next move up, let’s look at the views of three very capable market commentators who were correctly bearish on the gold price during 2013, that is, they thought that the price would drop. They were right, and perhaps their analytical work will continue being right. So let’s look at what they are saying now, and throw in the opinion of the head of the largest gold refinery in Switzerland as well.

Tom DeMark

The first analyst is Tom DeMark. Tom has been a trading advisor to the big institutions for decades. It’s rare for him to give his advice in advance to us commoners, though in his defense, he has published many of his techniques for those who wish to spend the time to learn them.

What DeMark said on December 16, 2013 about the metals is in the last minute of the short interview at this link. He said:

We’re looking for a huge move in gold next year, beginning next year. We think the bottom will occur with the tax loss selling this year.

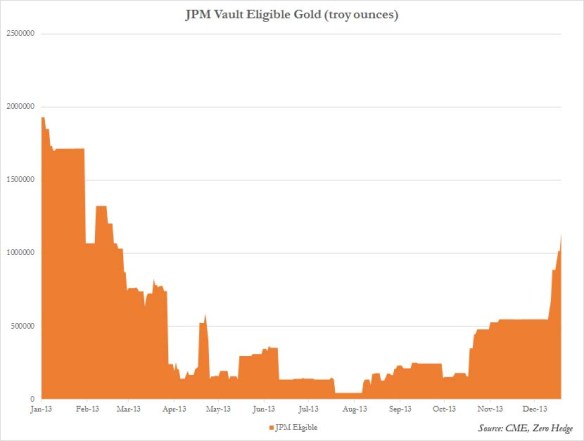

So what he is saying is that, as soon as those who want to take trading losses on their gold positions for tax purposes (to balance off other gains they had) finish that activity, then price will begin that “huge move” up that his firm is expecting. His price projection, for a long time, for the downside in the gold price had been $1180. In the interview, he said they had revised that to somewhere between $1155 and $1180. The price went down to $1181.40 on the last day of 2013, the last possible day for tax loss selling for the 2013 tax year. That’s probably plenty good for meeting his price target, but we’d have to be institutional clients of DeMark to know whether he now thinks price might still move down to $1155. In any case, by DeMark’s famous work, the price low is already behind us or will be here very soon. There will be evidence below that JP Morgan may have been following DeMark’s advice precisely.

William Kaye

The second fellow who was right about the gold price dropping in 2013 is veteran money manager and former Goldman Sachs employee, William Kaye. Kaye repeatedly gave interviews in 2013 on King World News where he would point out movements of physical gold in the markets that indicated the next phase of price manipulation down by the Fed and the big banks would happen promptly. And it would unfold as he predicted. In this December 31, 2013 interview, Kaye said he thought the gold price could be manipulated down one more time in January, followed by a large, fast move up for the gold price to somewhere between $2,000 and $2,500 in 2014:

My guess is we are now looking at mid-to-late January of 2014 as a probable and absolute bottom, after which it is going to be difficult for sidelined investors to gain a position because gold and silver will then move very, very quickly in the other direction. That is why most people are going to miss this move…

While all of the Western media is filled with anti-gold stories, China continues to buy virtually all of the available physical gold at these levels, and will continue to do so on any further price declines. Also, the flow of gold into India has continued because of increased smuggling. But none of the smuggled gold is being reported in the official import numbers.

One of the primary reasons this gold flowing into India is not being reported is because the politicians themselves control the smuggling rings. The reason India has such a large current account deficit and a loss of confidence in the Indian currency is because of the bad government policies. The people of India see this and so they seek refuge, as they always have throughout history, in gold…

As you know, Eric, I have extremely good sources and contacts in India because we’ve done business there for years. If our sources are correct, this year the gold imports into India are very close to 1,200 tons, which is a staggering figure.

On top of that, we have the Chinese importing a mind-boggling 2,200 tons of gold for 2013. That figure actually totals the entire global mine supply for all of 2013 outside of China…

You also have to remember that we have enormous demand from other countries around the world such as Russia, Brazil, just to name two…

Regardless, 2014 is going to be an extremely good year for the precious metals. I believe we could easily see new highs in nominal terms in both gold and silver. We may see $2,000 to $2,500 in gold, and $50 to $60 in silver, maybe even higher. The bottom line is that 2014 will be the year that the cartel gets broken.

Martin Armstrong

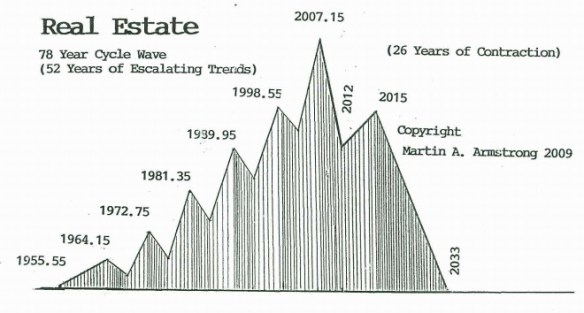

Our third commentator is Martin Armstrong. The guy has done some of the best financial cycles work in modern history. As examples, due to his real estate cycle work for the US, he was telling clients–in the 1990’s to give them ample time to act–to be out of all US real estate investments by February, 2007; that real estate prices would then fall from 2007 into 2012, then rise into 2015 in a snapback rally that would sucker a lot of people back into real estate, and then fall again through 2033. (Yes, real estate folks, you read that right, a 26 year bear market in real estate that started in 2007.) A summary of that work published in 2009 is here, and a look at the chart from the first page tells the story very well:

To say that this was good advice, at least so far, would be quite an understatement. Also in the 1990’s, he told his clients that interest rates/mortgage rates would fall till January 2013 and then start an inexorable rise for many years to come. He was only off by six months, interest rates went to their lowest level in mid-2012 and have been generally rising since.

So the guy is very smart. But I don’t have a link to his site on the Thundering Heard home page because it is nearly unbearable to read him daily. Anyone else’s views on anything, he calls those opinions, and pelts them with ridicule and insults if they disagree with his own opinions, which he claims are not opinions, but actual facts. His cycles work is fabulous, his knowledge of history is formidable, but when he strays from those, as he often does, you have to put your boots on and wade through it. That’s a worthwhile exercise, but you have been warned.

Anyway, Armstrong is our third analyst who was bearish on gold all year, to the point where he called anyone advising buying gold during 2013 to be a fool, criminal, and worse. But all year, he has expected a Directional Change (his capitalization) for gold in this month of January, 2014.

So with DeMark, Kaye, and Armstrong, you have three very capable analysts who think this price downmove is over, or will be in over in this month of January. If I were a person with savings denominated in fiat currency, I would be jumping all over this opportunity. But of course, people need to make their own decisions. As mentioned above, getting the free e-mails from GATA is a great place to start. And no, they don’t sell your e-mail address to others.

So what does the head of the largest Swiss gold refinery have to say about all this?

Alex Stanczyk: Physical Supply Never Been Tighter

I’ll let the article speak for itself:

Refineries in Switzerland are still working 24 hours a day to cast bars for China, sometimes having difficulties sourcing the gold…

We met with the managing director of the largest refinery in Switzerland and spend about two hours talking to him…Now, this gentleman we were talking to probably has a better idea of physical gold flow than anybody else globally. He sees what is coming from the mines, he sees what is coming from the UK, and all over the world, as well as where its going. He indicated the price didn’t make sense because he has got so much fabrication demand. They put on three shifts, they’re working 24 hours a day, and originally he thought that would wind down at some point. Well, they’ve been doing it all year. Every time he thinks its going to slow down, he gets more orders, more orders, more orders. They have expanded the plant to where it almost doubles their capacity. 70% of their kilobar fabrication is going to China, at apace of 10 tons a week. That’s from one refinery, now remember there are 4 of these big ones [refineries] in Switzerland.

…At this Swiss refinery there have been several times this year on which they were unable to source gold, this shocked me. They’re bringing in good delivery bars, scrap and dore from the mines, basically all they can get their hands on. This gentleman has been in the business for 37 years, he was there during the last bull market in the late seventies. I asked him when was the last time this has happened, that he was unable to source gold, he said never. And I clarified it, I asked: let me make sure if I understand what you’re saying to me, in the last 37 years you’ve worked in the gold industry this has never happened? He said: this has never happened.

When do think the price is going to rise?

“I’m not comfortable to put a time on this. What I do know is that we are on the threshold of a situation that has never occurred before. A squeeze is imminent, it could take 3 months or 6 months, but all I know is that it’s coming, and I know that with 100% certainty.”

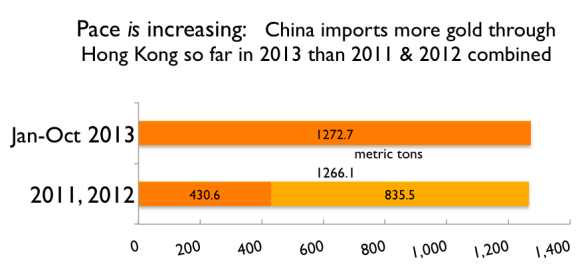

What Stanczyk is talking about is shown on the next chart, which has only been updated through the end of October. Hong Kong has imported more gold from Switzerland in 2013 than in all prior years combined!

(Chart source: China Mainland Gold Import Accelerating )

Here’s a way to look at the overall Chinese gold imports from Hong Kong:

(Chart source: China Imports More Gold Via HK In 2013 Than 2011 & 2012 Combined)

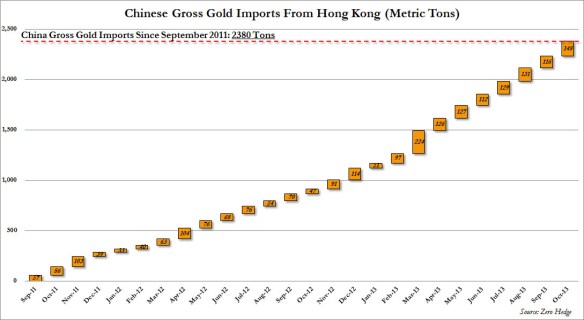

And here is a chart of total Chinese imports from Hong Kong by month since Autumn 2011. And this chart doesn’t show imports from other sources or China’s own mine production, which is now the largest of all countries and which is keeping six large refineries busy in China. There have been reports (blatant lies is what they are) in the Western media that Chinese gold imports have been falling. Does this look like falling to you? Each of those numbers are tons.

(Chart source: China October Gold Imports Surge To Second Highest Ever)

Despite strong government disincentives to buying gold in India, as we heard from Kaye above, the flow of gold can’t be stopped. Here’s a typical story:

Smugglers smile as NRI carriers bring gold into country legally

It was evident last week when almost every passenger on a flight from Dubai to Calicut was found carrying 1kg (2.2 pounds) of gold…

This strong buying is a worldwide story:

Including Canada, Australia, and the US, as reported here by the Wall Street Journal:

Sales of gold coins are booming even as the metal’s price is falling…at mints and coin shops around the world, gold continued flying off the shelves…

Sales of Gold Maple Leaf coins by the Royal Canadian Mint surged 82.5% to 876,000 ounces in the first three quarters of 2013 from the same period of 2012. The Perth Mint, Australia’s national coin and bar producer, saw sales rise 41% to 754,635 ounces last year, while the U.S. Mint sold 14% more American Eagle gold coins than it did in 2012, along with a record amount of silver coin.

Even JP Morgan, big sellers of their own horde of physical gold earlier, which helped to drive prices lower, has been rebuilding their cache, perhaps guided by Tom DeMark’s work, or perhaps to simply be the manipulating elephant that they have been caught being in so many other markets:

JPM’s Quiet Scramble To Refill Its Gold Vault

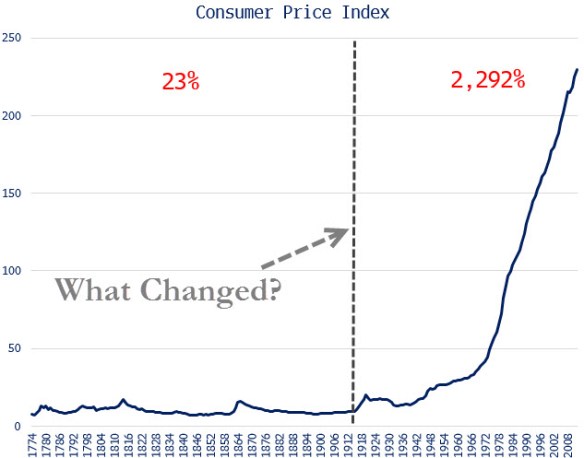

In Part 2, we’ll talk about how it is possible to have extraordinary worldwide demand for physical gold and still have a falling price.