In Part 1, the focus was primarily on economic, political, and legal lies in the USA. This time, let’s check in on Europe:

Euro crisis is over, says France’s Francois Hollande

The President of France was begging for money in Japan—politicians and bankers figure that if Japan is going to print money faster than anyone, they might as well go there and ask for some of it—and declared that the “Euro crisis is over.” This joins the regular chorus from Euro-politicians who have been claiming that “Europe is fixed” for years. And last week, the French head of the IMF, Christine Lagarde, speaking in Lithuania– which the Euro-pols are trying to sucker into the Euro fold—said there would be “a brilliant future for the Eurozone and the Euro.” Every time there is the tiniest uptick in any economic statistic, a Euro-pol will be out there claiming that the EU recession is over.

So let’s take a look. Maybe things are getting better! The OECD—the Organisation for Economic Co-operation and Development, a statistics agency for the largest 34 national economies in the world, also known as “the rich countries club”—just came out with a report on employment in all of their member countries. “The social scars of the crisis are far from being healed,” said OECD Secretary-General Angel Gurría at the launch of the report in Paris. Oops. Somehow that doesn’t sound like “fixed.” Here is a quote from a summary of the OECD report by Martin Armstrong:

The OECD has made it clear that the greatest obstacle to reduced unemployment remains the horrible labor markets in Europe, whose abysmal performance over the past five years has opened the door for extreme political movements and massive civil unrest. Looking at Southern Europe, Portugal’s jobless rate “has more than doubled from a pre-crisis average (for the years 2005-08) of 7.7% to a a projected 18.6% in 2014.” In Greece and Spain, the numbers are even more outrageous with the Greek pre-crisis average of 8.7% to a forecast 28.4% next year…This level is above the peak 25% in the USA during the Great Depression. The picture in Spain has jumped from 9.3% to 28.0%, also exceeding the peak levels on the whole of the Great Depression.

So things are bad, perhaps dangerously so, in Portugal, Greece, and Spain. What about Italy, whose national debt bomb ranks among the top five in the world?

Crisis is closing ‘134 retail outlets’ a day in Italy

(ANSA) – Rome, June 19 – Each day 134 shops, restaurants and bars close in recession-hit Italy, retail association Confesercenti said on Wednesday. Confesercenti, which represents small and medium-sized businesses in the retail and tourism sectors, said 224,000 enterprises had closed their shutters since the start of the global economic crisis in 2008.

“It’s a massacre,” said Confesercenti President Marco Venturi.

“Every day five green grocers, four butchers, 42 clothes shops, 43 restaurants and 40 bars and catering business close down”.

Hmmm, if retail is awful, maybe their industrial output is better? Nope, it’s fallen by 25% since 2008 and is back to where it was in the 1970’s:

Italy’s industrial output falls back to 1970s

Maybe France is better. Here’s a report from an analyst known for generally being a rather optimistic fellow:

Charles Gave: “France Is On The Brink of A Secondary Depression”

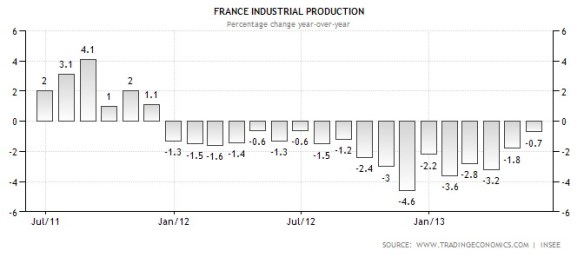

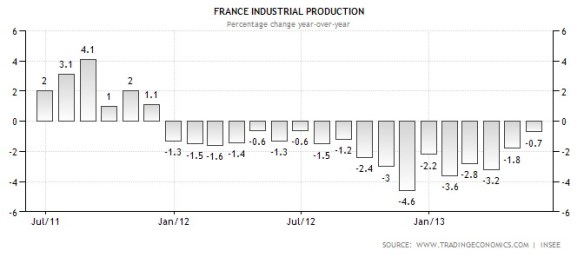

Here’s a chart of French Industrial Production. Notice it’s all minus signs for the last 18 months:

(Chart source)

And the fellow “tasked with fighting tax evasion by President Francois Hollande” has been brought up for charges of, what else, tax evasion:

France’s ex-budget minister Jerome Cahuzac ‘tried to invest 15 million euros’

Mr Cahuzac was charged with tax fraud after he admitted owning an undeclared foreign bank account containing some 600,000 euros ($770,000) last month.

However, Swiss public television network RTS reported on its website that the former leading Socialist once tried to deposit many times that amount, citing unidentified banking sources… Swiss newspaper Tages Anzeiger also claimed that when Mr Cahuzac decided to transfer money to Singapore in 2009 he provided a falsified tax certificate.

Mr Cahuzac, a cabinet heavyweight who had been tasked with fighting tax evasion by President Francois Hollande, finally admitted to having a foreign bank account last week, following weeks of denials.

But surely, if the “euro crisis is over,” then Italy, Spain, France, Greece, and Portugal must be the exceptions, overall Europe must be doing fine, right? Oops:

European car sales sink to 20-year low in first half

European car sales slumped to their lowest six-months total in 20 years in the first half of 2013, with a 6.3 percent drop in June.

Ah, it must be that the European countries have been tightening their belts: austerity! They must be paying down their debts, that must be what they mean by “fixed”? Nope:

Euro Area Government Debt Rises To New Record High

• Euroarea: 92.2%, up from 88.2% a year ago

• Greece: 160.5%, up from 136.5% a year ago

• Italy: 130.3%; up from 123.8% a year ago

• Portugal: 127.2%, up from 112.3% a year ago

• Ireland: 125.1%, up from 106.8% a year ago

• Spain: 88.2%, up from 73.0% a year ago

• Netherlands: 72.0%, up from 66.7% a year ago

Speaking of liars, the Spanish banks should be up for some kind of award. What they want to do is this: They have lots of losses from the ongoing real estate crash in Spain. If these banks ever become profitable again, they will be able to offset those losses against future profits for tax purposes. Fine. But what they want is to count those future tax offsets as capital. Now. You know, capital, something they can use to write new loans, to prove they are safe, etc. This is equivalent to you or me saying, “I bought some Apple stock at $690 back in September and sold it for a loss at $400 in June. Since I’ll get tax writeoffs for this loss for years to come, I want the bank to count that loss as money in my bank account now.” This is how rotting with lies the world banking system is, folks. If you been reading Thundering Heard, you can’t say you haven’t been warned about this. Accounting is one of the great new forms of lying.

Spanish Banks Petition To Convert Historical Losses Into Bank Capital

Well, what should we expect in a country where the ruling party has been operating a giant slush fund where rich folks and companies deposit money into the slush fund and it gets distributed to the party politicians. The President has been denying his involvement for two years, but now they have text messages showing his connection:

European Political Crisis Spreads – Leaked Texts Prove Rajoy Link To Illegal Party Funding

Even the IMF, infamous for its incorrect optimistic forecasts, has a tough time coming up with a rosy outlook for Spain:

IMF forecasts alarming Spain unemployment outlook

Spain will be stuck with an unemployment rate above 25 per cent for at least five more years, according to a forecast by the International Monetary Fund.

And Portugal, which has already been bailed out and is held up as an example of a bail-out success story, is going to need a new bailout by mid-2014, likely to the tune of $76 billion, to keep afloat. Perhaps the EU has commissioned a new Liars’ Dictionary with a new definition of the word success.

And the way they do their bailouts in the EU is quite curious: the European Central Bank (ECB) is not supposed to directly bail out countries. So they inject cash into that country’s insolvent banks in the form of loans. Those banks then buy the bonds of their insolvent government. And everyone looks more solvent. The ECB lies and says it is not printing money. Yet the balance sheet of the ECB is over $3 trillion, up from a far smaller amount in 2008. If the money isn’t being printed, where is it coming from, the Money Tree??? In other words, where did the $3 trillion come from?

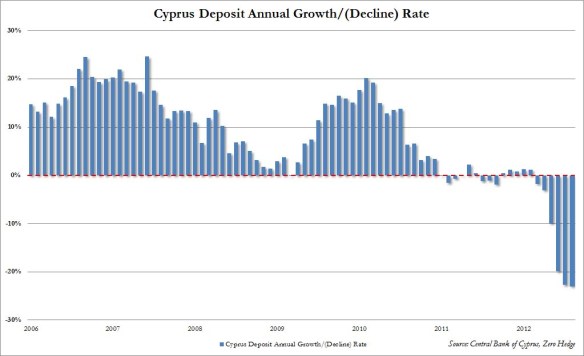

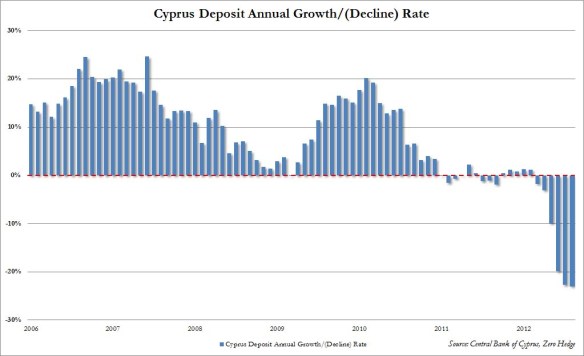

Back to countries: Cyprus is fixed as well. Sure, people lost 47.5% of their bank deposits, but they were given stock in their bank, surely that is working out. Nope, it turns out no one wants to keep their money in those banks and they are withdrawing as much as they are allowed to withdraw:

Cyprus Deposits Plunge At Fastest Rate In History

And in Greece, wow, things just keep getting worse:

Greece Laying off 25,000 State Workers

Greek Unemployment, Non-Performing Loans Soar To Fresh Record Highs

Greek Youth Unemployment Soars To Record 65%

On The Ground In Athens: “Too Many People Are Committing Suicide”

So I think we really need to ask President Hollande and Ms. Lagarde and the other Euro-politicians: Fixed for whom? Clearly not for the people. Perhaps they mean it is fixed for them! Most of the Eurozone office-holders were not even elected, they were appointed. Yet they are running around eating caviar at endless summit meetings and handing down regulations most of which are not reviewed by any referendum or democratically-elected institution. Sounds more like royalty than democracy. And come to think of it, an awful lot of law and regulation in the US now arrives by Executive Order, agency regulation, and court order, not by debate and voting. So what’s going on here? Has democracy become a mere facade? Are we witnessing the return of royalty? Is all the attention lavished in the media on Kate and William and what they are wearing today as they take their baby for a stroll some kind of diversion to make this all more palatable?

Next time, let’s look at lies in the Land of the Rising Radiation, Japan.