Now you can’t say that no one ever told you.

–David Daniels

In Part 7, I promised predictions for this installment. And there will be predictions. The important question is: predictions based on what? The web and the media present piles of predictions, most of which turn out to be wrong.

So based on what? Evidence; and a model of how things work. Most predictions go awry because they aren’t based on either. Or if they are said to be based on models, the models are flawed.

Evidence is what Part 1 through Part 7 were all about. And all of us, consciously or not, operate from models of what the world is like. If we walk into a dark room and flip a light switch, we are operating from a model of the world where electricity is flowing into a building with wires connected to lights controlled by switches, and flicking a switch–that often sits precisely where we expect it to be even if we’ve never entered that room–lights one or more light bulbs. We have all sorts of such models in our heads having to do with gravity, internal combustion engines, computers, shoelaces, banks, the properties of water, etc. When correct, these models have predictive abilities that make our interactions with the world relatively easy and efficient compared to operating without such models.

So these models lead to predictions about the future, and when correct, they yield excellent results. When we turn the key in a vehicle ignition, we expect the engine to start, and typically we aren’t disappointed. Thus we made a prediction about the future, one that has generally turned out to be true. Perhaps not every time. Once in awhile, the car might not start. But the results are good enough, the model reliable enough, that we rarely “give it a second thought.”

In my view, this scales up to the major aspects of our lives. Though it does seem that, the larger the scale, the greater the disagreements people have on the topic. Yet I contend that getting large-scale models right is important and possible. When we get the large scale models wrong, life can be unnecessarily confusing and difficult; when we get them right, the results can be profound.

Bias, the bringer of difficulty

We all like to think we aren’t biased, but on this planet at this time, that is a rare achievement. It runs deeper than we like to admit. Were that not true, the mystics would not have to advise us to pierce the veil. Without bias, we would likely see that there is no veil.

Let’s look at a good example of why people have a tough time getting large scale models right. This is one where, were it a multiple-choice question on a standardized test, most highschoolers would get it right. But on this one, the “masters of Wall St” got it wrong. Big time.

Several decades ago, one researcher pointed out that the economy of the USA operates on a roughly 25 year recession/depression cycle, that is, roughly every 25 years, there is either a recession or depression. Yes, there could be recessions at other times, but you could rely on the idea that one would happen roughly every 25 years. This cycle has been active since early in the 1800s and predicted that there would be a recession or depression starting ideally in December, 2007. I told a number of people about this ahead of time, and few thought the idea had merit despite the historical track record, part of which looked like this at the time:

9/1857: very serious recession 6/1857-12/1858 (18 months contraction)

2/1882: depression 3/1882-5/1885 (38 months contraction)

7/1906: serious recession 5/1907-6/1908 (13 months contraction)

10/1932: serious depression 8/1929-3/1933 (43 months contraction)

7/1958: recession 8/1957-4/1958 (8 months contraction)

12/1981: very serious recession 7/1981-11/1982 (16 months contraction)

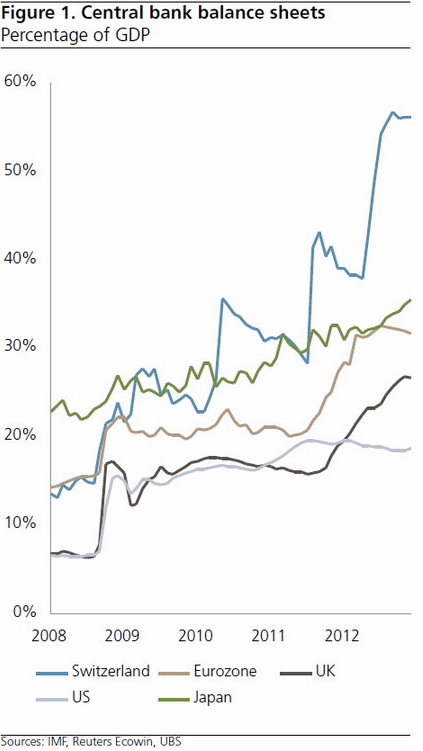

12/2007:

Every August, George Soros has a meeting at his Long Island estate for the biggest movers and shakers on Wall St. By August 2007, the sub-prime mortgage market was already falling to pieces. Soros asked his 21 guests, people who have the money to buy the purportedly best research on the planet, whether the current situation would lead to a recession in the US. Twenty of twenty-one said no recession. But right on schedule for the 25 year cycle, a recession started in December 2007. Some say we are still in the depression that started then, and there is good evidence for that.

So how come people would ignore such a prescient cycle with a long and excellent track record? First, because while most people are well aware of being surrounded by cycles such as heartbeats, breathing, night and day, moon phases, ocean tides, the seasons, years, birth and death, to name just a few cycles to which we are subject, they believe that such cycles couldn’t possibly apply to an economy, that such thinking is equivalent to voodoo. Second, the researcher who was the first to publish about this cycle was Edgar Cayce, and to most hard-nosed Wall St people who think they are operating by logic and science, how could Edgar Cayce possibly be right about anything. What they think of as hard-nosed is actually thick-skulled because Cayce was right about plenty of things. But he doesn’t fit their constrained view of “logic and science,” so out goes Cayce and anyone like him. While it would be fun to say “too bad for them,” when their firms failed in 2008, it was the rest of us who got stuck with the bill for bailing them out so they could keep their bonuses, stock options, and corporate jets.

So as we all know, in 2008 we got a humdinger (serious academic term) of a recession despite the bad models being used by the Wall St mavens and people like Fed Chairman Ben Bernanke that said we would not get a recession. So why did the masters of Wall St and most others dismiss such information? Probably because, if they heard the source of the prediction, most would discount something from Edgar Cayce because it was information channeled from the other side. And “everyone knows” that stuff is only for new age goofballs. So the real answer is: bias. People would rather hang onto their bias than admit that correct information is useful if they despise the source.

Oddly, another researcher, Manfred Zimmel of www.amanita.at, later figured out the basis for Cayce’s information. OK, check your biases. For some of you, this is about to get worse. Here’s that same recession/depression series from above exactly as I first saw it, presented by Manfred, in 2006:

Ø conjunction 9/1857: very serious recession 6/1857-12/1858 (18 months contraction)

Ø conjunction 2/1882: depression 3/1882-5/1885 (38 months contraction)

Ø conjunction 7/1906: serious recession 5/1907-6/1908 (13 months contraction)

Ø conjunction 10/1932: serious depression 8/1929-3/1933 (43 months contraction)

Ø conjunction 7/1958: recession 8/1957-4/1958 (8 months contraction)

Ø conjunction 12/1981: very serious recession 7/1981-11/1982 (16 months contraction) – last deep recession

Ø conjunction 12/2007:

Yep, you guessed it (heh), the cycle is actually the Jupiter-Pluto conjunction cycle. So an astrological model has reared it head! Yikes, so if the Wall Streeters had heeded either the channeled or the astrological model for this cycle, they could have saved their firms tens of billions in losses and turned 2008 into a year of tens of billions in profits by aligning their trading with the idea that a recession was very likely. This is not a stretch since there were hedge funds that did make billions from the financial collapse in 2008.

If a model is clearly working in significant ways, it is useful to ask whether allegiance to one’s biases is more important than being on the right side of major trends on this planet. One of the worst things a person can do in this rapidly-evolving environment is get in front of a major negative trend and stay put thinking that trend is not important. Millions have gone bankrupt in recent years doing just that. In the markets, they call it picking up pennies in front of a bulldozer. Sometimes having a good or bad model is a matter of life or death, for example, a bad model about the nature of the Nazi party brought horrific suffering and the deaths of many millions. (Side note: Thundering-Heard.com exists because I think understanding and heeding good models versus bad ones could very well be a matter of life or death over the next few years, or perhaps even months.)

Handling predictions

One more brief topic, and then on to predictions about the Transition: What is a person supposed to do when they hear a prediction about the world? Assuming that they want to do anything at all, here is an approach from some people whose livelihood depends on their expert handling of predictions. When you hear a prediction:

1. Put aside the natural human propensity for wanting to know immediately whether the prediction is correct. This is emotion coming to the fore. All of the remaining steps are about eliminating emotion from this process so that rationality, research, and observation can take their rightful place.

2. Consider the prediction a script about how the future will unfold.

3. After giving it some thought, assign a rating, say from 1 to 100, on whether you think the predicted event can possibly emerge from current conditions. If it has any chance of emerging, write down the script and place it in your script pile wherein scripts about the future are sorted by your numeric ranking. If there is no chance that the event can arise from current conditions, then throw it out.

4. If the outcome of a script would be important to you, do research on the topic and, if it is appropriate based on your research, adjust your numeric ranking for the prediction in the future script pile. If there is a way to investigate the track record of the person making the prediction, and on the internet there often is, this can help a lot in rating a prediction. People with a bad track record are typically operating from a narrow or faulty model and usually continue doing so. Few people, especially people who have achieved some fame using one model, will admit their errors and find a better model.

5. Watch as evidence about all of your scripts unfolds and adjust your script pile accordingly, tossing out scripts where emerging events show a script to be faulty, and upwardly adjusting the numeric rankings of those scripts where the evidence is pointing to the idea that they might be right.

Through this process, predictions that are false are discarded and those that are true rise to the top of the pile. Emotions are kept at bay, biases fall as evidence accumulates, observation and logic guide the process. And you learn a lot about how the world works.

The Evidence

So what have we observed?

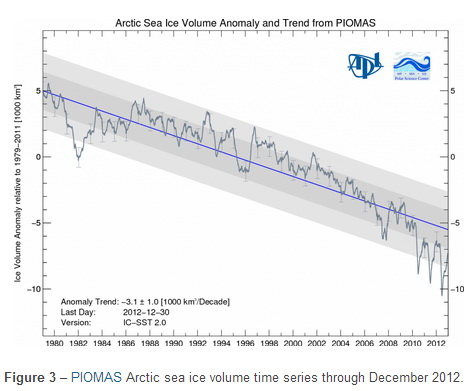

1. Acceleration, evident in a wide variety of ways, including:

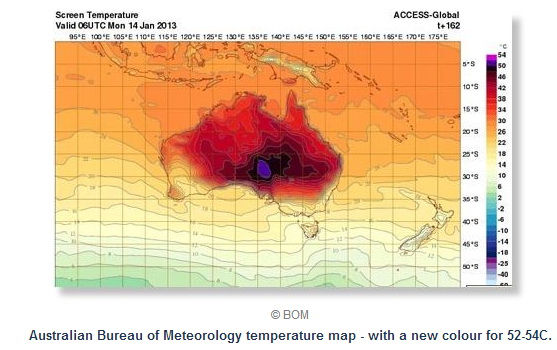

2. Weather extremes and wildness, including floods, windstorms, typhoons/hurricanes, tornadoes, heat waves, droughts, superstorms, etc. The insurance industry reports a greater than tripling of “loss-related weather events” since 1980. (Part 1)

3. Earthquakes of magnitude 6.0 or greater up more than 50% since 1990. (Part 1)

4. Tsunamis up fivefold in this century versus the last. (Part 1)

5. Volcanic eruptions clearly on the rise. (Part 1)

6. Magnetic poles on an accelerating shift accompanied by hemispheric temperature changes . (Part 2)

7. Sea level rise. (Part 3)

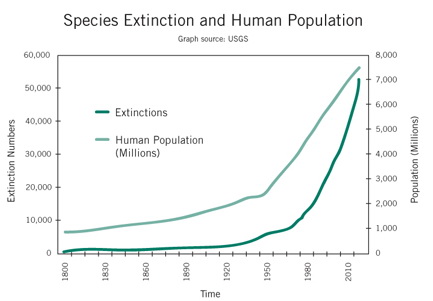

8. Species extinction rising exponentially along with rising human population. (Part 3)

9. Sinkholes increasing rapidly enough to go from obscurity to the mainstream media. (Part 4)

10. Asteroid encounters appear to be on the rise. (Part 4)

11. Nuclear plants compromised by the increasing earth and weather changes causing problems for people. (Part 4)

12. People’s perception of time as speeding up. (Part 5)

13. An exponential rise in the price/performance of technology. (Part 5)

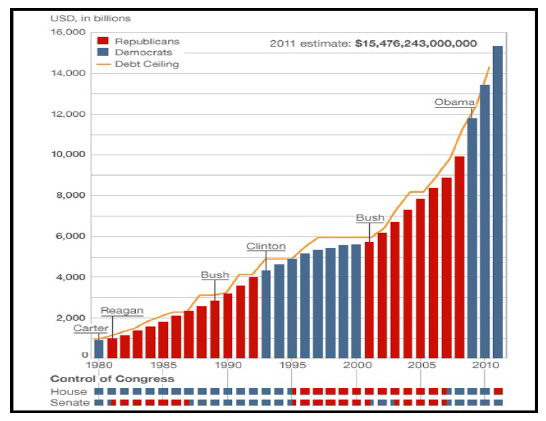

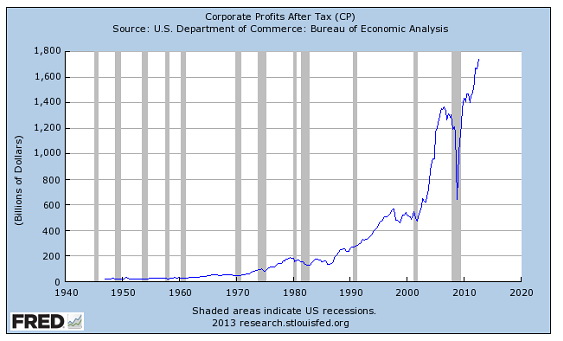

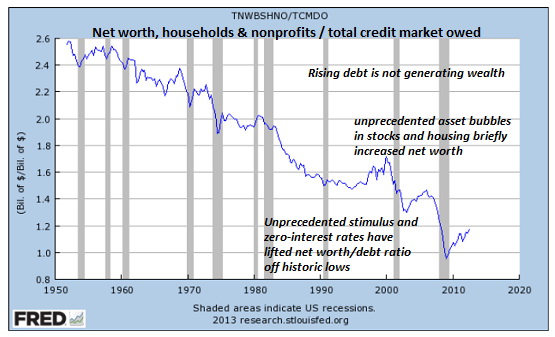

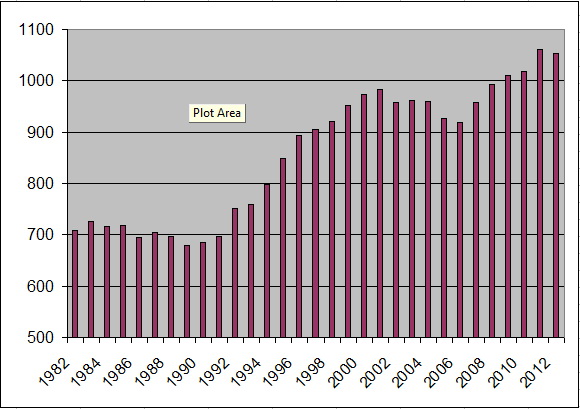

14. Exponential growth in money, debt, and unemployment. (Part 5)

15. Exponential growth in the amassing of physical gold by those, such as China and the oil sheikdoms, who supply real goods for all this printed money. (Part 5)

16. Relentless growth in the prices of real goods such as food and fossil fuels in response to the massive influx of printed money.

17. Despite an exponential increase in money printing, borrowing, and spending by governments to simulate economies, these same economies remain moribund and these tactics clearly show diminishing returns. (Part 5)

18. The “age of truth” brings increasing revelations of lies and truth. (Part 6)

And with people, acceleration is bringing increases in (Part 7):

19. Communication/connectedness.

20. Inner work.

21. Insistence on knowledge over belief.

22. Group consciousness.

23. A changing attitude toward the physical sciences.

And increasing exploration of (Part 7):

24. Healing methods.

25. The energetic nature of everything.

26. That energy is different at different locations on the planet.

27. The multi-plane nature of life.

28. Interaction with nature intelligences.

29. People changing from “what can I get” to “what can I do to help.”

And accelerating (Part 7):

30. General insanity.

31. Use of legal and illegal drugs and of alcohol to cope with acceleration.

Predictions

OK, so where will this lead us? Does anyone have a model that accounts for accelerating change in most if not all aspects of life on this planet? A model which we might then be able to look to for guidance about the future, from which we could actually expect some reliability?

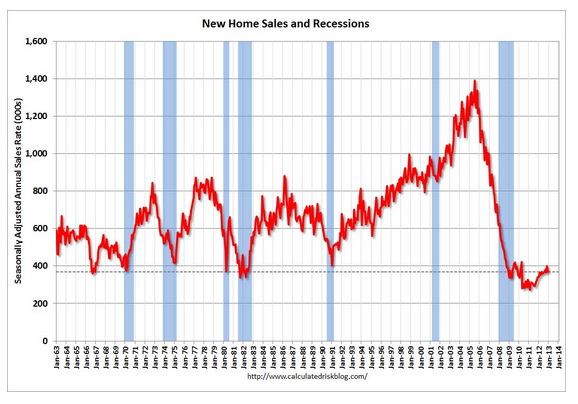

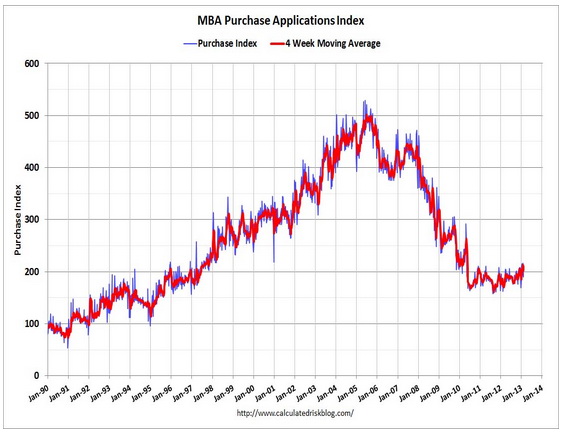

Surprisingly, yes. In early 2007, I was fortunate enough to run into such a model described in a book published in 2003. It went into my script pile at the time. Given that the book had been published four years earlier, I was able to evaluate whether a portion of its predictions were coming true or not, and they definitely were. I was already convinced prior to reading the book that we were likely to experience an all-out collapse of the financial system within 5 to 7 years. The book entirely agreed with that perspective, but it took things way beyond the financial world and covered the topic of the Transition from historical, geologic, meteorological, political, educational, occult, and cosmological perspectives, to name a few. And this wasn’t a book of vague wishy-washy predictions that could be interpreted several ways. It was exceedingly specific. Here is what it said—and this was in 2003, before the explosive growth of sub-prime mortgages being sold to anyone who could fog a mirror, with those mortgages being packaged up and sold to institutions across the world as blue-ribbon, good-as-gold, AAA-rated securities—about the real estate bubble. And this was when almost all people considered real estate a perfect investment, something whose price could never go down, something that was definitely not a bubble at all:

Many who pulled their money out of the stock market…rushed to invest these funds in real estate, but again this mad rush created yet another bubble of inflated real estate. Finance companies, mortgage brokers, and banks readily accorded mortgage loans to these buyers. Once they obtained the signature of the borrower on the loans papers, they sold the mortgages to non-bank secondary mortgage companies. In order to purchase these mortgages, these secondary mortgage companies borrowed money by issuing bonds and derivatives on these bonds.

In essence, though this convoluted maze of borrowing, these non-bank financial institutions…own indirectly most properties purchased with a mortgage…

As the world economy deflates, more and more people will lose their jobs, they will default on their house mortgage payments, and be thrown out into the streets. The sinister secondary mortgage companies will take possession of the property.

When mortgage defaults reach a critical mass, the secondary mortgage companies will collapse leaving a wasteland of properties. This will spell the end of the financial grip the Dark Forces hold on the world, and the towers of finance they have spent centuries to build will fall one by one like dominoes.

So what we have here is an exceedingly accurate description of the work-in-progress that is the real estate bubble and its associated derivatives taking down the financial system. Lots of “dominoes” have already fallen. In 2007, Wall St had five big investment banks. The sub-prime mortgage collapse took three of them to insolvency—Merrill Lynch, Bear Stearns, and Lehman Bros—which were either broken up or absorbed into other companies, and it would have taken down the last two, Goldman Sachs and JP Morgan, but the government temporarily stabilized them by saying the they were now backed by FDIC deposit insurance even though they had never before paid a penny into the FDIC insurance program. In fact, they had shunned the FDIC program because they wanted less regulation.

As tracked by the Mortgage Lender Implod-o-Meter, 388 US and 13 non-US mortgage lenders have gone belly up so far. This includes giants such as “secondary mortgage companies” Fannie Mae and Freddie Mac and lenders such Countrywide, Washington Mutual, and Wachovia Mortgage. (The full list is here.) And now with sinister companies like Blackrock rushing in to buy foreclosed houses, the game is not completely over, but it won’t be long before the dominoes have all fallen.

Anyway, back to this book I’ve been speaking of. Of the 31 trends identified above, this book covered 26 of them, and for all I know, I may have forgotten references to the other five.

The book is The Sanctus Germanus Prophecies, Volume 1 by Michael Mau. It was followed by Volume 2 in 2006, and Volume 3 in 2009. The books can be purchased here or here.

There are a lot of books out there these days that are really highly-padded versions of what could be a five or ten page article. Mau’s books are not in that category, as demonstrated by the quote above, that is, the real estate crisis was discussed in detail on one page and that was it, the author moved on to other topics. So an attempt to summarize the vast array of information in these books will do them serious injustice, but I will make the attempt anyway as a conclusion to this series of posts. The best advice, of course, is to read the books:

We are living in a period of transition during which much that impedes humanity’s evolution—warmongering, the manipulation/exploitation for power and profit of the many by a very few, the intentional distraction of people from their higher self, and so forth–will be cleared away. Energetic acceleration and earth changes will assure that this clearing/cleansing process takes place. The transition is a normal period of relative rest in the vast multi-billion year evolutionary cycle of our solar system called the manvantara in which people evolve through hundreds and even thousands of incarnations. Many people, called lightbearers in these books, incarnated now with the intention of helping people through this turbulent process and preserving, through the period of the transition, that which is conducive to people’s true evolution. The overall goal of the transition is to place humanity in a new golden age in which people can pursue soul liberation with excellent support and without interference. Getting to that golden age requires the dissolution of those organizations that serve the interests of those who seek to control everyone else for their own power and for material acquisition far beyond what any person would need during a lifetime. Since these organizations are not going quietly, we are dealing with increasing turbulence during which all people will have to decide where they stand with respect to war and the array of slaveries that permeate civilization. The degree of turbulence that can be expected is strongly related to whether or not people wake up and stand on the side of freedom and conscious evolution.

Volume 2 lists twelve regions on the planet that are called spiritual regions, higher elevation areas away from the coasts that, while not immune to the earth changes, are relatively safe with respect them, and which are conducive to lightbearers retrieving those abilities they cultivated in prior incarnations.

Here are some highlights from the timetable at the back of Volume 2:

2005-2012:

- Severe worldwide economic and financial crisis

- World economy hits bottom and stays there, all conventional efforts to revive it fail

- Water-related catastrophes: tsunamis, hurricanes, rise in sea level, floods of lowlands and coastal areas

- Spiritual Regions on higher ground begin to develop: initial preparations

2013-2020:

- Water-related catastrophes multiply making more and more low-lying areas uninhabitable

- Massive population displacements to higher ground

- Spiritual Regions take hold as lightbearers find their way there

- Period of Reconstruction: Transitional societies begin to consolidate in the Spiritual Regions

2021-2080

- Indications of major continental shifts, rifts, and movements begin to perturb the earth’s surface

There is a lot more to these books that what I’ve summarized here. They place the Transition in a perspective that ranges from the innermost to the cosmic. They say that, far from being over, that we are early in many of the accelerating trends identified above. These books have risen to the top of my “script pile.” They have become a stable platform from which to view the changes and turbulence in the world, and have given me confidence that life on this planet can and will be changed, and vastly for the better, and that this goal is way beyond worth working for. These days, when I hear a prediction–and I do seek out a lot of them–if it clearly conflicts with the information in these books, I relegate it to the category of “very unlikely,” and that repeatedly works very well.

One of the main reasons that so many predictions go awry is because they are drawn from experience of a small slice of life. We hear predictions all the time about finance, politics, weather, health, the use of energy, the environment, social trends, and now even meteors and comets. I contend that so many of those predictions go awry because they work from a narrow band and fail to take into account the larger context. Most would relate to maybe one or a few of the 31 trends identified above. Mau’s books place almost all of these individual trends in the context of a much larger one.

And seeing all of these trends in their larger context is precisely what we need right now as change permeates, well, just about everything! A narrowly focused model has no chance of accounting for across-the-board acceleration in, for example, finance, earth changes, mass shootings, and the emergence of truth.

So what’s a person to do about all this?

It is truly up to each person.

What would I do? I will provide a detailed post about that soon where I will contend that a wait-and-see attitude about these changes is no longer appropriate. Life is, as usual, being very kind by giving us a preview of exactly how this will all unfold by not bringing change all at once, but by ramping up all of these trends. But it’s up to us to read the signs and take action.

In the mean time, if you haven’t done so already, you may want to do your own research on these topics. If you come to some understandings, an action plan may naturally emerge from what you learn.

One piece of advice I would give is to never underestimate the power of an accelerating trend. As trends become obviously exponential, they can be quite breathtaking in their speed, power, and scope. As a friend from Cyprus told me: “On Friday night, when we went to sleep, everything was normal. On Saturday, we were told that the banks were closed and that we would have very restricted access to our bank accounts and that we might lose a lot of our the money.” When things change these days, they can change radically and quickly.

There are suggestions for dealing with the collapse of the financial system in the post What then can we do?.

And I leave you with outstanding comments on this topic from Gandhi: View the Forces of Nature bringing Earth Changes as Opportunity to Change the World.

Thanks very much for reading this long series and this long post.