…one goal is to get to the point where all market participants understand with certainty that if a large SIFI (systemically important financial institution) were to fail, the losses would fall on its shareholders and creditors…

–Governor Jeremy C. Stein, US Federal Reserve Board, Regulating Large Financial Institutions, speech at a conference sponsored by the International Monetary Fund, April 17, 2013

* * *

“Bank creditors,” as it happens, is a class of people that includes bank depositors. Everything about the rhetoric of banking is designed to obscure this. You deposit money in your bank account…But what you’ve really done is loaned the money to the bank…

—Slate.com

A big price drop in the precious metals. So let’s see, on Thursday, April 11:

CEOs of biggest U.S. banks to meet with Obama on Thursday

and the big selling in metals took place on Friday, April 12 and Monday, April 15. No chance of any causation in that correlation. Nah. Move along. As Leslie Nielsen said, “Nothing to see here.”

Anyway, with all that selling, there must be lots of inventory of coins around. That’s what they teach in Econ 101, right? That if a price is plunging, it’s because people are dumping large quantities of that item onto the market.

But there isn’t lots of inventory. Inventory is very tight, sold out in many cases. Delivery lead times are out to five or six weeks, and that’s if you can even place an order for what you want. Big-volume dealers like Tulving.com are entirely out of one-ounce silver coins minted by any country, and they have been since April 15. You can scroll down this page at their web site to see how many items they normally sell are currently sold out.

And these people make a living buying and selling lots of coins. They really want to do a lot of business. And they are happy to buy right now, but they can’t sell lots of items because there aren’t any available.

This scramble to buy physical bullion coins is going on worldwide.

In Australia:

The volume of business that we’re putting through is way in excess of double what we did last week,” Treasurer Nigel Moffatt said, without giving precise figures. “There’s been people running through the gate.”

In Japan:

As global price slumps, “Abenomics” risks drive Japan gold bugs

But on Tuesday, buyers outnumbered sellers by a wide margin. At Ginza Tanaka, the headquarters shop of Tanaka Holdings, gold buyers waited for as long as three hours for a chance to complete a transaction.

In India:

India’s Response To The Gold Sell Off: A Massive Buying Frenzy

In China:

Chinese Gold & Silver Exchange Society Runs Out of Gold…Importing from Switzerland and London

Now we discover that the Chinese Gold & Silver Exchange Society has essentially sold out of gold bullion, and must wait until Wednesday for shipments to arrive from Switzerland and London.

Gold Buying Frenzy Continues: China, Japan, And Australia Scramble For Physical

In the US:

US Mint Sells Record 63,500 Ounces Of Gold In One Day

According to today’s data from the US Mint, a record 63,500 ounces, or a whopping 2 tons, of gold were reported sold on April 17th alone, bringing the total sales for the month to a whopping 147,000 ounces or more than the previous two months combined with just half of the month gone.

Bullion Shortages Develop As Retail Demand Skyrockets

…on Monday there was such chaos in the markets that some of the larger wholesale dealers had to shut down at various times because of the massive demand on the buy side… Gold and silver buyers are still outpacing sellers by a stunning 50 to 1. There were premium increases on everything bullion related. The wholesalers are now telling us four to six weeks on silver maple leafs, and wholesalers quit taking orders on one ounce silver rounds.

In Canada and Europe:

Massive Run On Physical Gold & Silver At UBS & Scotiabank

At the Bank of Nova Scotia in Toronto the gold window has been absolutely swamped. I have confirmed there were people lined up in droves recently for multiple-hours at a time to buy gold and silver bars and coins….

“I then confirmed with UBS today in Zurich, Switzerland, that they are experiencing exactly the same thing. They told me people are waiting in long lines for bullion related bars and coins. The physical market is incredibly tight…

In Switzerland:

Refiners Can’t Keep Up With Massive Global Gold Demand

If you look at our company, as just one example, we did not have one single seller in the last few weeks.

So during this takedown in gold and silver there wasn’t one single seller, only buyers….

If we turn to the Swiss refiners, Eric, the premium over spot for physical gold is rocketing. Swiss refiners are unable to keep up with the demand for immediate delivery. They are working flat out, including the weekend, and still can’t keep up.

The Swiss refiners are seeing global demand coming in from everywhere, especially from the Middle-East and the Far-East. So, again, this proves that the artificial manipulation of paper gold has nothing to do with the physical market.

–Egon von Greyerz, Matterhorn Asset Management

So, with all that buying interest in real physical gold and silver, why has the price been falling? Because the two largest trading venues on the planet for metals, the LBMA (London Bullion Market Assoc.) and the COMEX in the US, are the places where the price of gold is currently set. And 99% or more of the trades there that are said to be related to gold are not for the physical metal, they are futures contracts that are traded for cash, not physical gold. In other words, these are very large trading casinos. But like the banks, they are fractional reserve systems. In other words, if everyone who had a futures contract for gold actually wanted physical gold for their contract, there would not be anywhere near enough gold to go around. Even supporters of the LBMA admit there is maybe 1% physical gold backing all these contracts. So that’s even more leverage than is used at most banks. A lot more.

Monday, April 15 was a good example. Andrew Maguire–an LBMA trader and whistleblower who the Powers That Be ran down, but did not kill, with a car in 2011 right after Andrew gave testimony on silver price manipulation to the authorities—reported that on Monday, there was a period during which 155 tons of gold was sold on the LBMA in one hour. I can tell you for sure that no one who owned or was the custodian for 155 tons of physical gold would sell it in a panic into a falling market. This was selling of futures contracts that will be settled in cash. They have little or nothing to do with physical gold. People in charge of 155 tons of real gold do not sell in a panic. If they wanted to sell—and such a thing would be quite unusual these days when even central banks are net buyers of physical gold—they would do so carefully, trying to get the best price. They would sell on days when the price was rising, not falling. This is the way anyone with a strong profit motive sells, they hire good traders to sell over time when they can get the best price. They do not panic dump their holdings regardless of price.

In fact, Maguire reports that central banks picked up 55 tons of physical gold during that one hour period when 155 tons worth of paper gold contracts were sold.

Here are Maguire’s comments about Monday, April 15.

At some point, this charade will fall apart. The price of physical gold will separate from the price quoted in these paper instruments. This is already visible when one needs to buy coins at a premium above the spot price of the metal. During these smashdown selloffs (we’ve seen these before in 2006 and 2008), the premium above the quoted spot price for physical gold and silver rises, sometimes to as much as 50% above the spot price if you want prompt delivery. During those periods, the price for physical coins is not the quoted spot price, it is the spot price plus the premium, and that price can be substantially higher. These are the indications of the separation of the paper and physical gold and silver prices to come.

The press duly reported nearly the same quote from representatives of all of the banks. Yes, reps from those same banks that met with Obama on April 11. “Gold has lost its safe haven status. “ “Gold is no safe haven.” And on and on. They should have dressed them up in silly costumes and they could have danced and sang together, at least that would have been entertaining.

So why do they want to scare you out of, or away from, gold and silver? Two main reasons:

First, so that you cough up your goods so they can buy them on the cheap.

Second, when they go to “Cyprus” your accounts, that is, when they want to confiscate some of your money, they want it easily available with a few keystrokes. Confiscating gold and silver coins would be inconvenient at best, dangerous at worst.

Do you think “they’ll never do that here”? Here is the overall order of events in Cyprus:

1. On Feb 10, the Financial Times published the plan for the confiscation of depositor money in Cyprus called Radical rescue proposed for Cyprus.

2. On Feb 11, the Central Bank of Cyprus posted a letter shown at this link saying that the Financial Times article was incorrect, that confiscating depositor money was against the constitution, etc.

3. In mid-March, the confiscation of depositor money was announced.

4. The Cyprus parliament voted against it.

5. The central bank of the EU overruled the Parliament of Cyprus and went ahead with the confiscation. So democracy and the constitution were thrown out the window along with the promises.

On the day after the confiscation, the new head of the EU finance ministers, Jeroen Dijsellbloem, gave not one, but two interviews in the mainstream press in which he said the Cyprus bank resolution was a new template for such actions. From Reuters:

A rescue programme agreed for Cyprus on Monday represents a new template for resolving euro zone banking problems and other countries may have to restructure their banking sectors, the head of the region’s finance ministers said.

The rest of the EU and IMF politicians nearly had a baby on the public stage. For the next three weeks, all they would say was that Cyprus was not a template. We should have put them in a chorus line too. Even Dijsellbloem tweeted that he didn’t say what he said.

But then a member of the US Federal Reserve Board, Governor Jeremy C. Stein, said that if a Too Big to Fail bank failed, that private investors and creditors would have to bear the losses. His speech was on April 17, well after the Cyprus event wherein depositors were ruled as “creditors” of the bank. These people choose their words carefully. I hope everyone out there listens to them carefully.

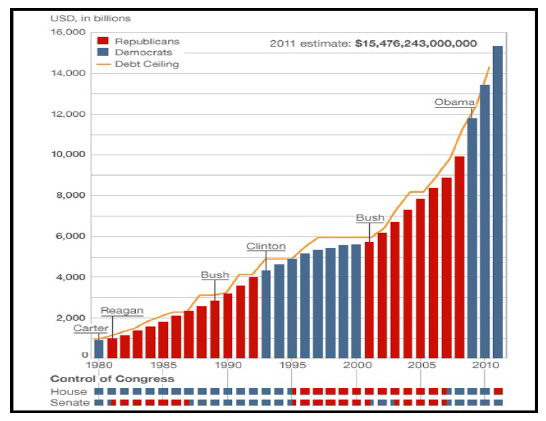

And it’s worth remembering this: In the US, for example, the bank insurance fund held by the FDIC has $25 billion. That’s the amount insuring $9 trillion worth of deposits. So that’s 370 times more deposits than the amount in the insurance fund. And the insured banks have an additional $297 trillion in exposure to derivatives. So that’s almost 12,000 times more than the amount in the insurance fund. Very safe and sound, eh? Now you know why the authorities have just hinted that banks won’t be simply bailed out anymore; people’s deposits will be bailed in. Just remember, they’ve put you on notice now that you need to determine whether or not your bank is safe. People who spend their whole lives trying to do that can’t figure out which banks are truly safe anymore, but so what, you are now supposed to be able to do that. You can see a chart of the FDIC situation here. And you can find out a little about the safety of any US bank at the Safe and Sound section here. I am not aware of what is available publicly available for bank analysis in other countries.

Also part of the Cyprus event were strong restrictions on how much money a person could take out of Cyprus, the dreaded capital controls. This is also part of the template. When that happens, people are stuck in their own currency even if it tumbles mercilessly in value. When people tried to switch their money into the electronic currency Bitcoins because it recognizes no borders, it doubled the price of Bitcoins in a few weeks. TPTB then smashed down the price of Bitcoins as well, to show people that there is “no safe haven.”

Throughout history, currency devaluations, capital controls, and asset confiscations are denied until after they have happened. Governments typically say, “Sorry, we didn’t want to do that, but we had no choice.” You need to either anticipate them or be a connected government crony. Here’s a chart of monthly deposits into and withdrawals from the Cypriot banking system. The large withdrawals in January and February show the strong likelihood that some people were given advance notice:

Most people were not given advance notice; if the time comes, you and I will be in that group.

Lots of people are showing that they understand. As the stories above show, people were waiting in line for metals at these prices across the globe. We have seen this play before. Sometimes the elites smash down the prices of metals. Did I see it coming? Nope. Can they do it again? Yep. But as the rising price of gold over the last 12 years proves, they can’t push it down too far. If they do, the Asians and regular people will end up owning all of the gold. And the banksters won’t like that at all since they know the financial (per)version of the golden rule: he who has the gold makes the rules.

Lots of regular people on the planet take these price smashes as a gift. I think these people are smart.

Here is Jim Sinclair’s latest comment on the topic: The US Will Be Cyprused & We Will See $50,000 Gold.

And the recently-released video The Secret World of Gold, while not perfect, has Andrew Maguire briefly explaining how gold and silver prices are manipulated, and brings up the interesting question of whether there is any real gold (and not just gold-plated tungsten bars) at the US gold depository at Ft Knox. Channeled information agrees that Ft Knox is empty of real gold. It will be a very interesting day when the world finds out about that.