Sea Level Rise

Have you ever seen a film of a three mile by one mile chunk of glacier falling into the sea? If not, and if you have four minutes to spare, now you can, by clicking on this link for an excerpt from the film Chasing Ice, which concludes, by the way, with a classic example of acceleration.

It helps to see films like that since the noise in the media on sea level rise is nearly deafening. A $120 million war chest can be used to make a lot of noise:

Secret funding helped build vast network of climate denial thinktanks

Folks like these, joined by the industry spawned by the fossil fuel companies and oil exporting countries, stridently deny lots of things about climate change. In fact, some of them claim that we are right on the verge of a new ice age. They often seem to feel the need to yell rather loudly to drown out stories like this:

Satellites reveal sudden Greenland ice melt

Melt ponds cause the Arctic sea ice to melt more rapidly

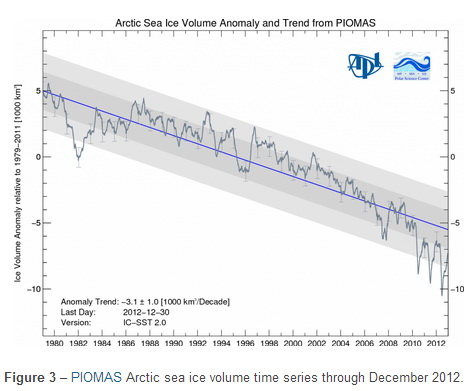

And charts like this that show the longer term trend for Arctic sea ice (source):

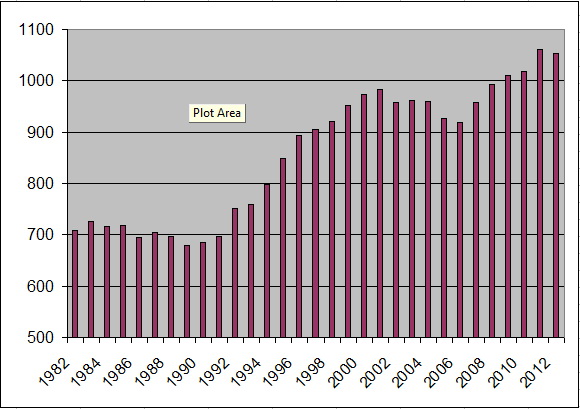

and of course the chart of sea level rise itself:

Claims and counter-claims aside, there are, undeniably, people losing their homes to rising sea levels:

Papua New Guinea: Carteret Islands: ‘The sea is killing our island paradise’

The people of the Carterets, for 300 years ignored by all but a few passers-by, can lay claim to a dubious distinction: within the next six months, some 240 of them – 40 families – will leave for good, driven from their homes by sea-level rise. In five years, half of the population, estimated at 2,500 people, is expected to have been evacuated to bigger, less vulnerable islands, some of the first refugees displaced as a result of man-made global warming. Some believe the islands will be uninhabitable by 2015.

The view from beneath the waves: climate change in the Solomon Islands

The smaller outer islands in the Solomon Islands are already seeing devastating impacts of the rising sea level. The impact of climate change is already affecting the rural population of Solomon Islands, an archipelago of eight bigger islands and hundreds of small, mostly uninhabited islands…Taro, the staple root crop in Ontong Java atoll, is dying due to salinity of the swamp and sandy soil. And graves at the Tuo village cemetery, an island in the eastern Solomons have been exposed by eroding waves.

During the 1980s the burial place was about 50m away from the beach. Today the beach is about 1m with only one cross remaining as the rising sea had washed most away.

Unless Tuvaluans adopt the lifestyle of the Marsh Arabs and build their houses on stilts over water, and that’s where they live 24 hours a day, eventually most, if not all, of the island will become uninhabitable.

Micronesia: A Third Kind of Nation, Written Off?

“Even the dead are no longer safe in my country,” Micronesia’s Ambassador to the UN told ABC News at his mission’s offices on a rainy day in New York.

He gave us recent digital photos of his home islands.

In one, a man stands shin-deep out in a calm and sunny sea … where a cemetery used to be.

In others, colorful traditional burial grounds spill out of a wave-eroded bank onto the tiny remaining beach, and water surges inland past tumbled houses.

Sea change: the Bay of Bengal’s vanishing islands

The tiny Pacific island nation of Palau is a paradise on earth. This band of several hundred islands is home to some of the world’s most stunning marine life, and to the twenty thousand people who live there.

But like many low-lying nations across the world, Palau is threatened by the effects of climate change and sea-level rise.

Palau’s coasts are being eroded, its local farmlands tainted by seawater, and its valuable reefs threatened. Johnson Toribiong, President of Palau, calls the damage he’s witnessing “a slow-moving tsunami.”

Kiribati, the Maldives, Torres Strait Islands, Cook Islands, many small islands of the Philippines, and the inhabited areas Barbados–all are getting inundated.

And it isn’t just the small islands that are having trouble. Large cities like Jakarta are facing dual difficulties: sinking land from the draining of freshwater aquifers combined with rising sea levels (source):

Experts in Indonesia are preparing to build a huge wall to stop the ocean from swamping parts of Jakarta.

Some suburbs in the capital already go underwater when there is a big tide but the problem is expected to get even worse.

Jakarta is sinking by up to 10 centimetres a year and Indonesia’s national disaster centre says with oceans rising, large parts of the city, including the airport, will be inundated by 2030.

Flooding and high tides are already causing problems for some residents in the city of 10 million people.

New York is still suffering the effects of the elevated storm surge from Superstorm Sandy.

London completed the Thames Barrier in the early 1980s to deal with rising tides boosted by increasingly powerful storms. They raise the barrier in the Thames when rising ocean waters threaten to flood London and the Thames Valley. In the 1980s, they raised the barrier 4 times; in the 1990s, 35 times; and from 2000 through 2010, 80 times.

And according to Scientific American, Shanghai, which means “above the sea” is finding itself on its way to being below the sea. The city has spent billions of dollars fending off the encroachment of the sea:

But the city’s biggest concern remains the slow, steadily mounting threat that comes from sea level rise. Higher tides are washing away the precious delta soil upon which the city’s foundations are built, and water supplies are becoming more tainted as seawater intrudes more deeply into the fresh water of the Yangtze.

Species Extinction

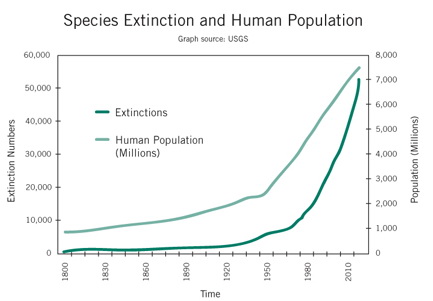

It seems that major changes in conditions on the planet give rise to the extinction of a large number of species. This has happened five times in the last several hundred million years. The most recent such event saw the demise of the dinosaurs. Some observers—such as the US Geological Survey for the chart below—offer data that points to the idea that we are in the middle of the sixth such mass species extinction event:

This indicates that the changes we are experiencing are way beyond trivial.

Here is Part 4.